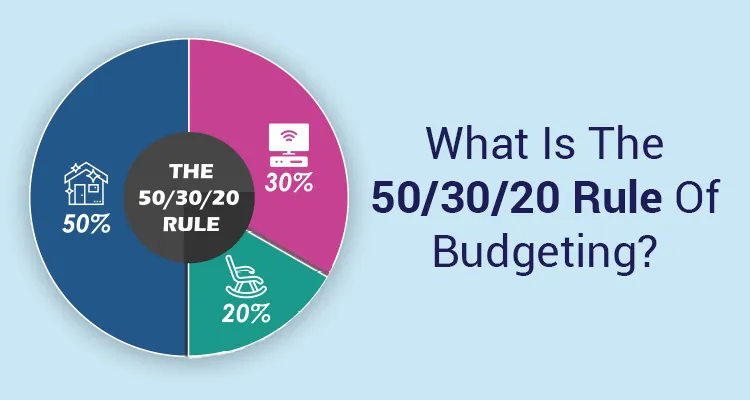

The 50-30-20 rule is a popular budgeting guideline that allocates your income into three categories: needs, wants, and savings. While it’s primarily used for budgeting, it can also be applied to investing strategies. Here’s how you could adapt the 50-30-20 rule for investing:

50% for Essential Needs:

Allocate 50% of your investment portfolio towards low-risk, stable investments that provide steady returns. These investments should form the foundation of your portfolio and help cover essential expenses such as housing, utilities, groceries, and healthcare. Examples of investments in this category include:

- Fixed-income securities: Bonds, Treasury securities, or high-quality corporate bonds offer relatively stable returns and lower risk compared to stocks.

- Certificates of Deposit (CDs): CDs provide a fixed interest rate and principal protection, making them a low-risk option for preserving capital.

- Dividend-paying stocks: Blue-chip stocks with a history of stable dividends can provide income while offering some capital appreciation potential.

30% for Discretionary Wants:

Allocate 30% of your investment portfolio towards higher-risk, growth-oriented investments that have the potential for higher returns but also come with greater volatility. These investments can fund discretionary expenses such as entertainment, dining out, travel, and luxury purchases. Examples of investments in this category include:

- Equities: Invest in a diversified portfolio of individual stocks or equity mutual funds/ETFs across different sectors and geographic regions to capitalize on growth opportunities.

- Real estate investment trusts (REITs): REITs allow you to invest in real estate properties without the hassle of property management and offer the potential for income through dividends and capital appreciation.

- Sector-specific funds: Allocate a portion of your portfolio to sectors with high growth potential, such as technology, healthcare, or renewable energy.

20% for Savings and Investments:

Allocate 20% of your investment portfolio towards long-term savings and investments that can help you build wealth and achieve financial goals such as retirement, education, or major purchases. This category should prioritize investments with a long time horizon and the potential for significant growth over time. Examples of investments in this category include:

- Retirement accounts: Contribute to tax-advantaged retirement accounts such as 401(k)s, IRAs, or Roth IRAs to benefit from tax-deferred or tax-free growth over the long term.

- Index funds or ETFs: Invest in low-cost, passively managed index funds or ETFs that track broad market indices such as the S&P 500 or total stock market, providing diversified exposure to the equity market.

- Individual stocks: Allocate a portion of your portfolio to individual stocks of high-quality companies with strong growth prospects and competitive advantages in their industries.

By following the 50-30-20 rule for investing, you can create a well-balanced portfolio that addresses your financial needs, desires, and long-term goals while managing risk effectively. Adjust the allocations based on your individual risk tolerance, investment horizon, and financial objectives to create a personalized investment strategy that aligns with your unique circumstances. Additionally, regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals and risk tolerance over time.