Insurance is one of the 8 major types of Business and is regarded as the most crucial aspects of financial planning in 2023. The concept of insurance provides a safety net against unexpected events that could otherwise late to financial turmoil. Now a days there are abandoned of options available in insurance but in order to understand each one of them you need to understand the basic and these different types of insurance, especially, if you are business student.

Insurance Concept Background:

The concept of insurance is centuries old and his origins can be traced back to various ancient civilizations. Whoever, in the western wear the concept of insurance routes back to the maritime Insurance of 17th century in England.

It was conceptualised by the Lloyd of London who founded the modern concept of insurance. Edward Lloyd coffee House became a meeting place for ship honours motions and underwriters who collectively under written and distributed the risk of maritime trade.

The first noun insurance contract was drawn up in 1347 in Genoa, Italy. This Maritime insurance played a pital role in covering the parallels of the sea especially the threat of that time was pirates. The concept of the insurance continued to develop over the centuries and now these 6 types of insurance are widely common in 2023.

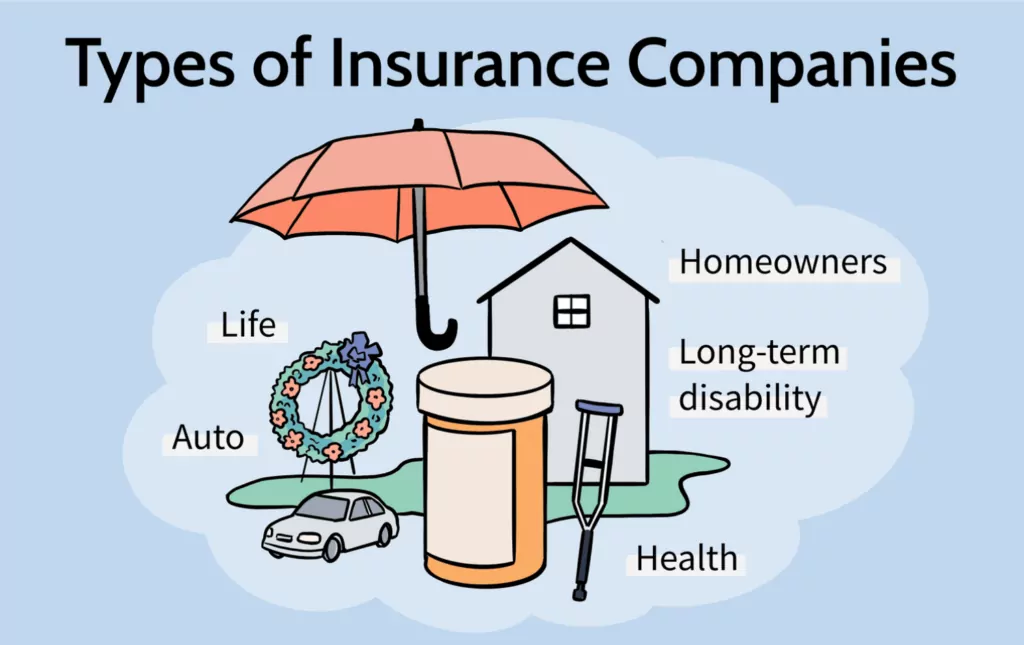

In this article we will explore 6 key types of insurance and will help you determine which one might be pass it for your needs

- Life Insurance

The most sold insurance is health insurance because it provides financial protection for you and your love once in the event of your death. It seems horrific to think that, if you have a beautiful family and all of a sudden one day you pass away due to your natural death, then what are you what are you leaving behind for your love ones. To address this issue there are two types of life insurance:

Term life insurance

Whole Life insurance

Term life insurance: Term Life insurance is more affordable and covers you for a specific term.

Whole Term Insurance: who Life Insurance isn’t self explanatory term which means that it will provide you life insurance for your whole lifelong time. Your choice depends upon your financial goals, needs of your depends and your long term plans.

- Health insurance

Health Insurance is perhaps one of the most vital form of coverage and it is also recommended by a lot of wise people. It have a person to offset the high cost of medical care and ensure that you can access the treatment without raining a lot of your savings on health. Before investing in the health insurance consider factors like your health condition lifestyle and budget for a better health insurance plan.

Like Life Insurance there also many policies that covers the preventive care prescription medication and even also alternative therapy in health Insurance.

- Auto Insurance

If you on a vehicle then Auto Insurance is not just a legal with my man but also a practical necessary in today’s traffic. It protects a person financially in case of accident after damaged to a vehicle. One should evaluate his driving habits the value of call and also the local insurance requirements before choosing an Auto Insurance.

- Disability insurance:

Disability insurance also provides the income protection if you are unable to work due to illness or injury. Celebrities athletes and especially Messi has invested a lot in disability insurance. It has a person to maintain a lifestyle and cover as an shail expenses during the challenging time of the life.

- Renters Insurance

A piece of real state is really an expensive one and protection of your house should be your priority. Renters insurance also known as home owners insurance covers the structure of your home and its content especially if you are going to place your house for a rent. Renters insurance only covers your belonging so consider the location of your residence value of your positions and any potential race when deciding on coverage.

Final Remarks:

In order to choose the best insurance for you needs you have to be careful and consider your personal circumstances financial goals and risk of tolerance. Remember, and insurance the one size fits all solution does not exist so its anchal to regularly re assess your coverage as your life evolves. It is best to consult a financial advisor who can provide you valuable insights and help you build a comprehensive insurance strategies that will protect you, your love ones and also your hard money.